The perfume industry in Sri Lanka, with its deep-rooted history and connection to the island’s abundant natural resources, is witnessing a significant transformation in its approach to packaging and sustainability. This shift is driven by global environmental concerns, changing consumer preferences, and a growing awareness of the ecological impact of packaging materials. This article explores the current trends in sustainable packaging within the Sri Lankan perfume industry, highlighting innovations, challenges, and the potential for future developments.

The Shift Towards Sustainability

Globally, the conversation around sustainability in packaging has gained momentum, and Sri Lanka is no exception. The perfume industry, traditionally reliant on elaborate and often non-recyclable materials, is reevaluating its practices to align with sustainable development goals. This shift is not merely a response to regulatory pressures but also a strategic move to cater to the increasingly eco-conscious consumer base.

Biodegradable and Recyclable Materials

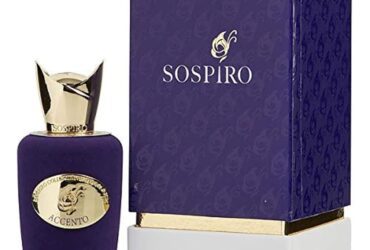

One of the most notable trends in the Sri Lankan perfume industry is the adoption of biodegradable and recyclable materials for packaging. Glass, which is widely used in perfume packaging due to its inert nature and ability to preserve fragrance integrity, is being embraced more because it is 100% recyclable. Moreover, innovations in glass production have led to lighter, less resource-intensive variants, reducing the overall environmental footprint.

In addition to glass, there is an increased use of other eco-friendly materials such as recycled paper and cardboard for secondary packaging. These materials not only reduce waste but also offer opportunities for creative branding and aesthetic appeal, which are crucial in the luxury-oriented perfume market.

Reduction in Packaging

Another significant trend is the reduction of packaging layers. Traditionally, perfumes are sold in elaborate boxes with multiple layers of wrapping, which, while enhancing the unboxing experience, generate considerable waste. Sri Lankan perfume brands are increasingly adopting a minimalist approach, simplifying packaging without compromising the product’s luxury feel. This not only involves reducing the physical amount of packaging but also designing it in a way that maximizes efficiency in transport and storage, further reducing the carbon footprint.

Local Sourcing and Production

The trend towards local sourcing of packaging materials is also gaining traction. By sourcing materials locally, perfume companies can reduce transportation emissions, support local economies, and have better control over the supply chain’s sustainability practices. This is particularly pertinent in Sri Lanka, where the abundance of natural resources can be leveraged to produce sustainable packaging solutions that reflect the local ethos and reduce environmental impact.

Challenges to Implementation

Despite these positive trends, the transition to sustainable packaging is not without its challenges. One of the primary obstacles is the cost associated with sustainable materials and processes, which can be significantly higher than conventional alternatives. This cost is often passed on to consumers, making sustainably packaged products more expensive and potentially less competitive in price-sensitive segments of the market.

Additionally, the availability of technology and materials that meet both the aesthetic and functional requirements of perfume packaging while being environmentally friendly is still limited. This gap often forces companies to make trade-offs between sustainability and product appeal, which can be a critical factor in the luxury goods market.

Future Outlook

Looking ahead, the future of sustainable packaging in the Sri Lankan perfume industry appears promising but requires continued innovation and commitment. Advances in biotechnology, for instance, offer exciting possibilities such as bioplastics derived from agricultural waste, which could provide sustainable alternatives to traditional plastic pumps and caps.

Moreover, as consumer awareness and demand for sustainable products continue to grow, it is likely that more companies will invest in sustainable practices, further driving innovation and reducing costs. The role of government regulations and incentives will also be crucial in shaping the industry’s move towards sustainability.

Leave a Reply